1 Personal direct lenders also give pupil financial loans, generally at much better fascination fees, but don’t have Advantages like consolidation and forgiveness options.

Jalin Coblentz has contributed to Progress The united states because 2023. His encounters like a father or mother, comprehensive-time traveler, and qualified tradesman give him fresh Perception into each particular finance subject matter he explores.

Essential Information regarding Methods FOR OPENING A fresh ACCOUNT. To help you The federal government combat the funding of terrorism and dollars laundering activities, federal legislation calls for all fiscal establishments to obtain, validate, and report data that identifies All and sundry who opens an account.

Tennessee: The State of Tennessee requires a minimum amount principal reduction. So that you can comply with the minimal point out-expected principal reduction, Fast Hard cash needs that least payments contain a principal reduction of two% or $two.

Payday lenders also usually have adaptable acceptance specifications, so there will not be a lot of explanations why you'll get denied for just a payday loan.

How can on line installment loans for poor credit score get the job done? On the net installment financial loans for poor credit history allow borrowers to consider out a mortgage and repay it over a set time period in typical installments. All the approach, from application to acceptance, is usually done on-line, which makes it hassle-free for borrowers.

Make sure you contact or go to your neighborhood retail store for aspects on all out there repayment solutions. You should take into account that if You can not repay your bank loan in total on its due day, you must Get in touch with us 1 banking day prior to your loan is thanks.

Keep away from settling. Offered there are dozens of direct quick-term lenders during the US, it’s ideal that you simply Look at a number of before you make any type of a choice. See what options you have got out there and come across the right lender for the borrowing desires.

Payday loans, installment loans and auto title loans come with superior rates and fees, which may trap you inside a cycle of debt. The vast majority of brief-expression financial loan borrowers renew their bank loan at the least at click here the time, piling on fees which make it even harder to repay.

When you implement that has a direct lender, your individual data will stay with that lender, limiting your likelihood of identity theft.

What exactly are negative credit score financial loans? Undesirable credit score loans are intended for individuals with a lousy credit rating historical past or constrained credit history practical experience. They offer a chance for these people to borrow cash, albeit often at increased interest costs.

Buyers with credit rating challenges ought to seek out credit score counseling in advance of moving into into any personal loan transaction.

If you’re experiencing an unpredicted unexpected emergency cost, the need for velocity is usually critical. You might not be capable of put off your payments, so obtaining approved for a financial loan as promptly as possible - often right before your next payday - could be your aim.

Financial institutions and credit score unions cost these expenses to address The prices of a bounced check when there aren’t enough resources within your account to cover the repayment.

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Dolly Parton Then & Now!

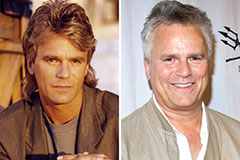

Dolly Parton Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!